Behind MLM 24th May 2023

Liquidators in South Africa have issued a summons against eighteen of Mirror Trading International’s top net-winners.

Together, the scammers are being held liable for R4.66 billion (~$244 million USD).

As reported by My Broadband’s Jan Vermeulen on May 10th, liquidators arrived at the $244 million amount “to cover the scheme’s debts – with 7% interest”.

According to the liquidators, these individuals are “masterminds” of the scheme, and it has asked the Pretoria High Court to hold them liable in terms of the Companies Act.

They argue that Mirror Trading International (MTI) was an unlawful Ponzi scheme and factually insolvent since its inception.

The liquidators also contend that the defendants knew this.

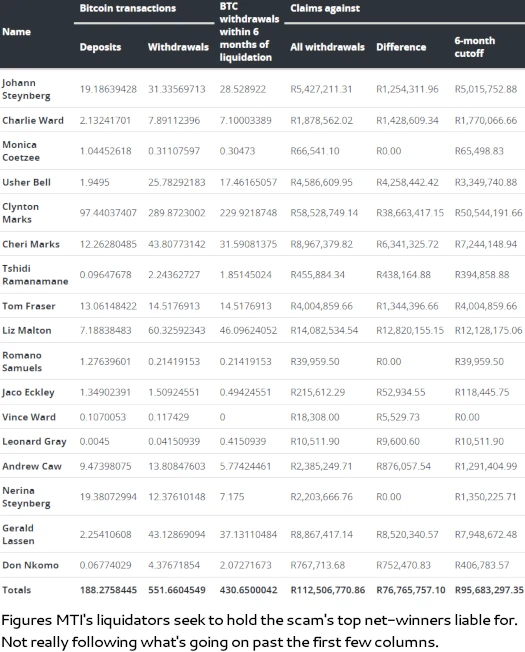

A chart provided by My Broadband details how much each MTI net-winner is up for:

Names of particularly significance are:

- Clynton Marks (suspected MTI co-owner with wife Cheri) – withdrew 289.8 BTC

- Cheri Marks (suspected MTI co-owner) – withdrew 43.8 BTC

- Johann Steynberg (MTI CEO and suspected frontman) – 31.3 BTC

- Andrew Caw (frontman of the Marks’ previous Ponzi (BTC Global) – 13.8 BTC

Vermeulen got in touch with suspected Mirror Trading International co-owner Cheri Marks (right with Clynton) for comment.

Marks unsurprisingly trotted out the usual denials.

“There are some very concerning aspects of the application,” Marks stated.

“We have always denied the contention that MTI was trading fraudulently or recklessly with our knowledge.”

She also maintains that MTI was never insolvent.

While it’s not nothing, the CFTC has pegged MTI as a $1.7 billion Ponzi scheme. The ~$242 million liquidators in South Africa have come up with falls well short of that amount.

Around ~$57 million in recovered bitcoin has already been liquidated, but that doesn’t really add much (~$300 million all up).

As to the remaining ~$1.4 billion unaccounted for, the bulk of what wasn’t paid out is believed to have been stashed by Clynton and Cheri Marks.

To date nobody seem to have been able to hold them accountable. The CFTC only sued Mirror Trading International and Johann Steynberg. South African authorities have failed to take any meaningful action.

The Marks continue to live openly on what they stole through Mirror Trading International (and BTC Global) in South Africa.

0 Comments